Over the past two years, the flash memory market has been in a slump, but the rise in flash memory chip resources in the fourth quarter of last year led to a continuous increase in the prices of flash memory products, and the market has undergone a reversal.

Will the Chinese flash memory market completely recover in 2024, or will it take a sharp turn? What significant impact will the AI boom in China have on the flash memory market? Will QLC SSD truly enter the year of popularization this year? What new trends will there be in flash memory-related hot technologies such as PCI-E 5.0 and CXL this year?

Recently, at the China Flash Memory Market Summit, flash memory companies from around the world introduced market and technology-related dynamics. From these key pieces of information, Big Data Online brings everyone a glimpse of the truth.

AI Boosts Flash Memory Recovery

Since the rise of large models, computing power has been a hot topic in the field of artificial intelligence. However, with the continuous development of large models and other artificial intelligence technologies, many challenges in the data storage layer have gradually been exposed. At this summit, companies such as Solidigm, Hynix, and Samsung all talked about the challenges brought by AI from the storage layer.

Advertisement

At present, the impact of AI on the storage layer is comprehensive. First, the massive amount of data and exponential growth brought by the multimodal trend of large models, with Gartner predicting that the proportion of data generated by artificial intelligence will reach 10% by 2025; secondly, storage needs to meet the performance requirements of GPUs on the performance level, as much as possible to help improve the utilization rate of GPUs; third, with the continuous improvement of capacity density, the challenges of storage power consumption, space, and cost cannot be ignored.

"Reports show that in some specific scenarios, storage power consumption accounts for as much as 35% of the entire server power consumption. Under the trend of rapid development of AI, storage power consumption is a challenge that must be faced," said Ni Jinfeng, Vice President of Sales for Solidigm Asia Pacific.

Nowadays, the development of large models and other artificial intelligence technologies has become a large-scale, high-quality data and efficient data processing engineering challenge, and it has brought a chain reaction to related scenarios such as data centers and edge sides. Combined with the development momentum of China's artificial intelligence "hundred model war," the impact of AI on the data level will become more prominent.

If we carefully analyze from the perspective of AI needs, we will find that AI brings fundamental changes to the storage throughput, capacity, scalability, etc. So, how to meet the data storage needs brought by AI?Currently, there are two technological paths: one is the high-capacity hard disk technology, which enhances storage capacity by increasing areal density and the number of platters; the other method is flash memory, leveraging the advantages of high capacity and low power consumption to achieve a balance between storage cost, power consumption, space, and capacity.

Ni Jinfeng believes that the rapid development of artificial intelligence technology is revolutionary for storage demands, and the advantages of flash memory in terms of performance, capacity, and overall cost will gradually emerge.

From a market perspective, the significant investment in large models and other artificial intelligence technologies in the North American market has already begun to drive the emergence of demand for ultra-high-capacity SSDs; Ni Jinfeng predicts that the domestic market's demand for high-capacity SSDs will catch up in 2024.

QLC SSD is gaining momentum comprehensively.

The recovery of the storage market is most directly reflected in the increase in capacity demand.

In the field of flash memory, the capacity density has solidified a solid foundation in 2023. Companies such as Solidigm, SK Hynix, Yangtze Memory Technologies Co., Ltd. (YMTC), and Samsung have all pushed the number of NAND layers to new heights. Taking Solidigm as an example, it has been promoting QLC SSD-related products in the market and launched a QLC SSD with up to 61.44TB in 2023.

The industry believes that QLC SSD has been widely verified in terms of quality, reliability, and lifespan, and will gain momentum comprehensively in 2024, becoming the mainstream choice in the market.

Specifically, in the consumer and mobile markets, QLC SSD is entering the PC and mobile phone fields in large numbers. This year, with the development of large model technology and the rise of concepts such as AI phones and AI PCs, it will also accelerate the application of QLC SSD products. Ni Jinfeng predicts that this year, due to the reduction in production capacity, the QLC SSD market may face supply and demand tension; in the long run, without the expansion of production capacity, long-term demand will definitely drive the QLC SSD market.

Similarly, in the enterprise market, the proportion of SSDs in Chinese data centers is still relatively low. With the development of technologies such as ZNS, PCI-E, and CXL, as well as the promotion of applications such as artificial intelligence and big data, QLC SSD is also becoming a mainstream choice and is expected to enter the mainstream of enterprise data centers comprehensively. For example, storage array manufacturers such as DELL EMC, NetApp, and Inspur Information have all launched flash memory products based on QLC SSD in 2023. With the comprehensive adoption of QLC SSD by storage array manufacturers, storage products based on QLC SSD are expected to enter the data centers of more enterprise users in 2024.

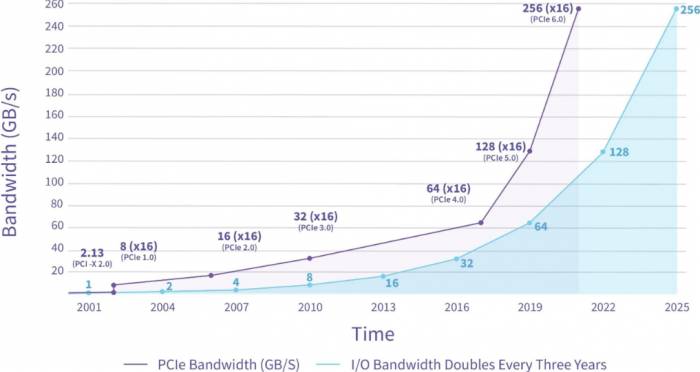

Furthermore, PCI-E 4.0+QLC SSD has been widely applied in data center scenarios with intensive reading and some mixed reading and writing; with the commercialization of PCI-E 5.0 related products, it will continue to promote the popularization of QLC SSD and other products in the future.At present, it appears that the consumer and enterprise-level markets are ready. In the consumer market, QLC will accelerate the replacement of TLC; while in the enterprise-level market, it will replace HDD. Ni Jinfeng believes.

The construction of the ecosystem is a long and arduous task.

The rapid development of the flash memory market is inseparable from the long-term and positive construction of the ecosystem.

It is well known that flash memory hardware has been in rapid development over the years, but considering the characteristics of the Chinese market users, such as the current situation in operating systems, processors, applications, etc., software innovation and ecosystem construction are crucial for the popularization of new flash memory technologies and products.

Ni Jinfeng frankly stated that the characteristics of Chinese users determine that the data center application environment is very complex, and it is more necessary for all members of the ecosystem to promote the promotion of flash memory. Taking the acceleration and application innovation related to QLC SSD as an example, the current situation requires the joint efforts of cloud computing customers, enterprise-level customers, OEM/ODM, operating system manufacturers, and other parties.

For example, many data center users generally have various service architectures such as Intel, AMD, ARM, IPU/DPU, GPU, and will encounter issues such as mixed workload optimization, storage capacity and performance utilization, and write amplification. To this end, Solidigm has been using CSAL software to do the cache layer, promoting the complex optimization of data center work, effectively adjusting the write workload to sequential writing, and greatly improving the storage efficiency of the data center.

"CSAL has been open-sourced, and everyone in the ecosystem can adopt it, thereby further promoting the popularization and application of flash memory," Ni Jinfeng introduced.

Furthermore, the rise of AI is a good opportunity for the renewal and replacement of data center infrastructure. Taking Kingsoft Cloud as an example, WPS has added AI functions, completing the upgrade from HDD to pure SSD at the infrastructure level, and involving issues such as accelerating AI workloads, optimizing infrastructure, and improving GPUs at the storage level. Kingsoft Cloud has cooperated with Solidigm and other ecosystem partners to achieve a significant improvement in AI data cleaning from 9 hours in the past to 11 minutes now.

"Hardware progress will lead to the simplification of software. Hardware and software are a step-by-step development process, which cannot be separated from the joint promotion of the ecosystem chain," Ni Jinfeng concluded.

Leave a Comment